RAK ICC Compliance Made Simple: RBR, UBO and Renewals (2026 Guide)

Recent Insights

Table of Contents

Why Compliance Matters in 2026

By 2026, the idea of running offshore companies quietly has largely disappeared. The UAE has taken clear steps toward openness, aligning its rules with global anti–financial crime standards and enforcing corporate tax regulations more strictly. As a result, offshore structures now operate in a far more visible and regulated environment. RAK ICC still offers strong advantages for holding companies, regional growth, and long-term wealth planning. But these advantages only apply to companies that remain properly maintained and demonstrably active. Simply having a registered entity is no longer enough to enjoy the benefits.

What’s driving this shift is the growing link between local regulation and international compliance expectations. Today, compliance is not optional; it’s part of staying operational. The introduction of a 9% federal corporate tax on profits above AED 375,000 has also placed offshore companies directly under the Federal Tax Authority’s supervision. RAK ICC entities now fall within a shared penalty framework. Businesses that address issues early and disclose them voluntarily are treated more fairly, while ongoing neglect can lead to penalties and operational difficulties. For a company to function smoothly whether for trade, investment, or asset holding, it must maintain a clean, transparent record that satisfies both the registry and the strict compliance checks used by international banks.

2026 Compliance Snapshot

For the executive who requires an immediate overview of the 2026 obligations, the following snapshot summarizes the critical actions required to maintain a RAK ICC entity in good standing. This summary reflects the integration of the RAK ICC Business Companies Regulations 2018 and the various Cabinet Decisions governing beneficial ownership.

RAK ICC Compliance Action Matrix 2026

| Compliance Pillar | Key Requirement | Filing Deadline |

|---|---|---|

| Annual Renewal | Payment of registry and agent fees; provision of updated KYC. | 30 days prior to expiry. |

| UBO Registration | Identification, filing of the Ultimate Beneficial Owner (natural person). | Within 30 days of incorporation or 15 days of change. |

| RBR Submission | Maintenance and filing of the Real Beneficiary Register. | Within 30 days of incorporation or 15 days of change. |

| Corporate Tax | Mandatory registration for the UAE Federal Corporate Tax. | Per FTA timelines (usually post-incorporation). |

| Accounting Records | Maintenance of financial records for a period of 7 years. | Continuous (Available upon request). |

| ESR Filing | Economic Substance Reporting (for relevant activities). | 6 months (Notification) and 12 months (Report) after the financial year-end. |

What Annual Compliance Really Looks Like for RAK ICC Companies

When people hear the phrase “annual compliance,” they often assume it means paying a renewal fee and waiting for a certificate to arrive. In 2026, that understanding is no longer accurate. For RAK ICC companies, annual compliance has become a broader process that confirms whether a company is still operationally credible, properly structured, and fit to remain active within the UAE’s regulatory system.

In practical terms, annual compliance is how a RAK ICC entity reaffirms three things every year: that it still exists as a legal entity, that the individuals behind it are correctly identified, and that its records would withstand scrutiny if reviewed by regulators, banks, or tax authorities. This is no longer a one-day exercise. It is a recurring checkpoint that determines whether the company continues to operate smoothly or begins to encounter friction across banking, renewals, and transactions.

The Registered Agent’s Central Role

One aspect of RAK ICC that often surprises new owners is how much responsibility sits with the Registered Agent. Unlike some jurisdictions where directors or shareholders interact directly with the registry, RAK ICC companies operate entirely through a licensed Agent. The registry does not accept compliance filings, updates, or renewals directly from owners.

The Registered Agent is more than an administrative contact. They provide the official registered address in Ras Al Khaimah, maintain statutory records, and act as the first line of compliance oversight. In reality, the Agent functions as a gatekeeper. If compliance requirements are not met to their satisfaction, filings do not move forward, and renewals can stall regardless of whether fees have been paid.

Annual KYC Refresh and Enhanced Due Diligence

Annually, at time of renewal, RAK ICC Companies are required to undergo a full KYC refresh. And that includes all shareholders, directors and beneficial owners. Many owners neglect this step, thinking that last year’s documents can just be reused.

That’s no longer the case in 2026. Registered Agents are increasingly asked to think beyond basic identification. They still need to start with a clean passport scan. More agents are expected to know about the origins of wealth, how funds have been sourced, and if company activity fits with that background. This kind of scrutiny is part of a trend in the UAE for substance over form.

Accounting Records and Financial Accountability

It is true that RAK ICC International Business Companies are not typically required to submit audited financial statements to the registry. However, this has led to a common and risky misunderstanding. The absence of a filing obligation does not remove the responsibility to maintain proper records.

RAK ICC entities are obliged by law to retain their accounting books for a period of not less than 7 years. These accounts must cover transactions in a manner that the company’s financial position can be ascertained without guesswork. It’s an eligibility requirement that could loom larger than ever in 2026. The Federal Tax Authority is able to request records during a review or audit, and companies that can’t produce them often pay penalties or face processing delays, or even a longer scrutiny.

RBR and UBO: Two Concepts That Are Often Confused

The Real Beneficiary Register (RBR)

The Real Beneficiary Register is an internal register maintained by the Registered Agent. Its scope is deliberately broad. It is designed to capture any individual who ultimately owns, controls, or influences the company, whether that influence is direct or indirect.

This means the RBR does not stop at share certificates. It looks at voting rights, contractual arrangements, nominee structures, powers of attorney, and any other mechanism through which control can be exercised. The purpose of the register is to give a clear and complete picture of who truly sits behind the company and how decisions are shaped in practice.

The Ultimate Beneficial Owner (UBO)

The UBO concept is narrower and more focused. It identifies the natural person, or persons, who sit at the top of the ownership structure and ultimately benefit from the company’s activities. As a general benchmark, this is usually someone who owns or controls 25% or more of the shares or voting rights, or who otherwise exercises decisive influence over the company.

In real terms, the UBO is the individual who benefits economically from the structure, even when layers of corporate ownership or nominee arrangements exist. Correctly identifying and disclosing the UBO has become a cornerstone of modern compliance, influencing everything from registry approvals to banking relationships and tax assessments.

RBR vs. UBO Comparison 2026

| Feature | Real Beneficiary Register (RBR) | Ultimate Beneficial Owner (UBO) |

|---|---|---|

| Legal Basis | RAK ICC Beneficial Ownership Regs 2019. | Cabinet Decision No. 109 of 2023 (superseding No. 58 of 2020). |

| Primary Focus | The entire chain of control and benefit. | The natural person with 25%+ ownership/control. |

| Data Points | Name, nationality, DOB, address, and grounds of control. | Name, nationality, address, and passport details. |

| Submission | Filed with the RAK ICC Authority. | Registered in the UAE federal database via RAK ICC. |

| Confidentiality | Non-public; held by registry. | Non-public; accessible to FTA/Ministry of Economy. |

| Change Deadline | 15 days from the date of the change. | 15 days from the date of the change. |

RBR Compliance (2026): Process, Documents, Deadlines

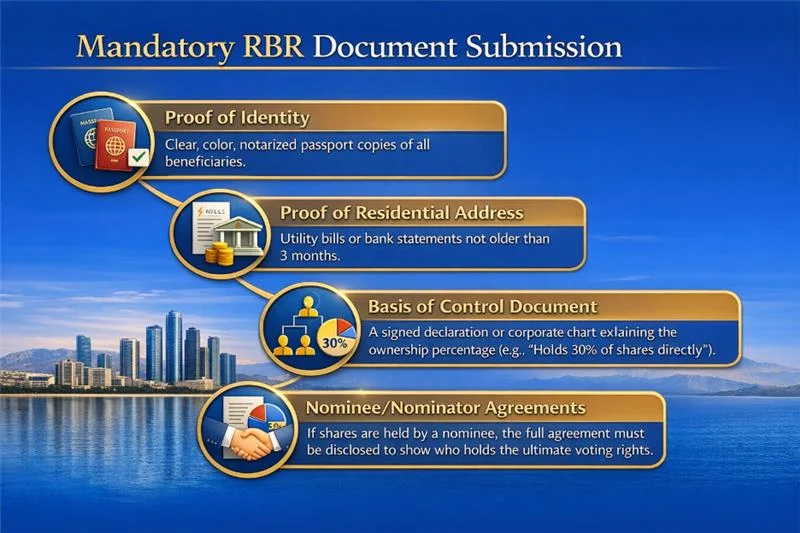

The RAK ICC RBR process is a mandatory governance obligation for every legal entity registered in the zone. Under the Beneficial Ownership Regulations 2019, the Registered Agent is tasked with ensuring the “true, accurate, and complete identity” of the beneficiaries is recorded.

The Step-by-Step RBR Process

- Notification and Inquiry: The Certified Registered Agent must serve a legal notice to any person they have reasonable grounds to believe is a beneficial owner.

- Verification: The recipient must confirm their status and provide corrected or missing particulars within the legally specified timeframe.

- Register Entry: The Agent enters the “Required Particulars” into the RBR, including the date the person became (or ceased to be) a beneficial owner.

- Registry Submission: The Agent uploads the digital register to the RAK ICC portal for official recording.

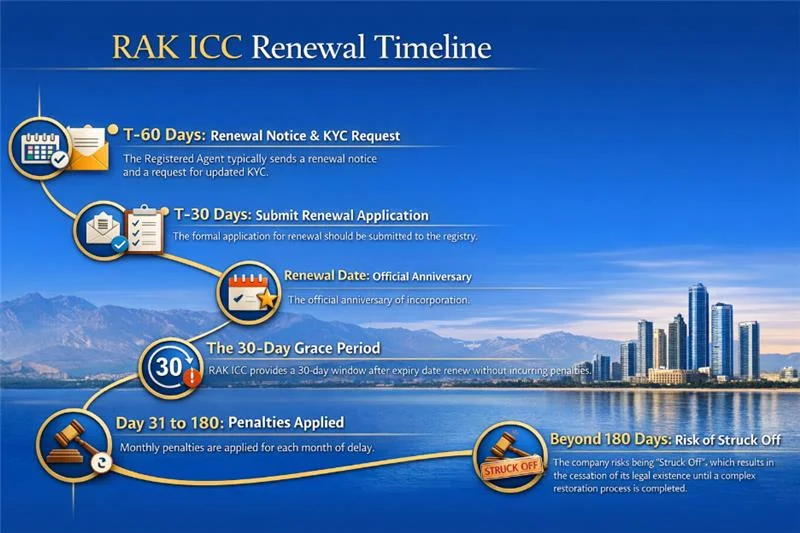

Deadlines and the 15-Day Rule

The RAK ICC RBR submission deadline is critical. For new companies, the RBR must be filed within 60 days of incorporation. For existing companies, any change in the beneficial owner’s data, including a change of address or a transfer of even a single share, must be updated in the register and notified to the Registrar within 15 days.

UBO Compliance (2026): Requirements, Registration, Reporting

The UBO RAK ICC requirements in 2026 are governed by a strict “cascading test” used to identify the natural person in control. This methodology ensures that even in complex multi-jurisdictional structures, a human being is always identified as the accountable party.

The UBO Cascading Test

- Ownership/Voting Rights: Any individual owning or controlling 25% or more of the shares or voting rights.

- Ultimate Control: If no person meets the 25% threshold, the UBO is the person who exercises “ultimate effective control” through other means (e.g., the right to appoint the majority of managers).

- Senior Management: If no individual is identified through ownership or control, the Senior Management Official (e.g., the CEO or Managing Director) is registered as the UBO.

RAK ICC UBO registration process

The registration process is digitized via the RAK ICC agent portal. The company must provide the “Required Particulars” of the UBO, which include their full legal name, nationality, date and place of birth, and notification address. A copy of their travel document (passport) or ID card is mandatory.

RAK ICC UBO annual reporting

While the initial filing occurs at incorporation, UBO RAK ICC requirements include a “standing obligation” to keep the information current. In 2026, the registry performs periodic audits. If the registry discovers that a UBO has changed (e.g., through a global acquisition of a parent company) and the RAK ICC entity has not reported it, the penalties are applied immediately.

Appointment of a UAE Resident Point of Contact

A specific requirement of Cabinet Decision 109 is that every RAK ICC company must appoint a natural person residing in the UAE as a “Point of Contact” for the Registrar. This individual is responsible for disclosing any data or information requested by the authorities. Failure to provide this contact’s name and Emirates ID copy is a specific violation with a dedicated fine.

Renewal in 2026: Timeline, Process, and Documents

The RAK ICC renewal process 2026 is designed to be efficient, yet it serves as the annual “health check” for the entity. A company that fails to renew is effectively paralyzed, losing its legal standing and its ability to operate bank accounts.

Required Documents for Renewal

The documentation required for re-registration or renewal depends on the shareholder structure:

- Application Form: Signed by the authorized signatory.

- Updated KYC: Refresh of passport and address proof (dated within the last 3 months) for all individuals.

- Certificate of Good Standing (for Corporate Shareholders): If a corporate entity owns the RAK ICC entity, it must provide a recent Certificate of Good Standing (or Incumbency) proving its own legal standing in its home jurisdiction.

- Board Resolution: A resolution from the corporate shareholder approving the renewal (if required by the Agent).

Costs & Transparency: What You Pay and Why

The RAK ICC renewal cost in 2026 is competitive, positioning the jurisdiction as the most cost-effective premium offshore Centre in the Middle East. However, transparency is key to understanding the total expenditure.

RAK ICC Cost Breakdown 2026 (Estimates)

| Fee Component | Estimated Amount (AED) | Frequency |

|---|---|---|

| Registry Renewal Fee: | AED 2,000 – AED 3,750. | Annual |

| Registered Agent Fee: | AED 7,500 – AED 12,500. | Annual |

| Registered Office Provision: | Included in Agent Fee. | Annual |

| Corporate Tax Registration: | Professional fees vary. | One-time |

| Certificate of Good Standing: | Approx. AED 500 – 1,000 | Optional / Per request |

RAK ICC offshore cost 2026: Value vs. Price

While the raw RAK ICC renewal cost is lower than JAFZA (where renewals often exceed $4,500), the value of RAK ICC lies in its digital speed. In 2026, the “cost of compliance” includes the professional fees paid to agents who ensure the company does not trigger RAK ICC compliance penalties. An agent who charges suspiciously low fees may not be performing the necessary KYC/UBO filings, leaving the owner exposed to fines that far exceed any initial savings.

Penalties, Risks, and Operational Impact

The RAK ICC compliance penalties in 2026 are structured to deter negligence and ensure the integrity of the UAE financial system. These penalties are divided into registry-specific fines and federal tax penalties.

UBO and RBR Penalties (Cabinet Decision 132 of 2023)

Failure to comply with beneficial ownership requirements is a high-risk violation. The fines are tiered:

- First Violation: A written warning and a notice to be corrected within 15-30 days.

- Second Violation: Fines ranging from AED 10,000 to AED 50,000 depending on the specific clause violated.

- Third Violation: Fines up to AED 100,000 and the potential suspension of the commercial license.

Key UBO/RBR Penalties 2026

| Violation | Penalty (First Time) | Penalty (Second Time) |

|---|---|---|

| Failure to create RBR | Warning. | AED 50,000. |

| Failure to update RBR | Warning. | AED 15,000. |

| Failure to create Shareholder Register | Warning. | AED 50,000. |

| Failure to provide UAE Point of the Contact | Warning. | AED 10,000. |

The “Strike Off” Risk

If a company is struck off for non-renewal or non-compliance, it is not merely “paused.” The legal entity continues to exist only for the purpose of liability; the members and directors are not free from their responsibilities. Restoration of a struck-off company can take months and involves paying all backdated fees plus restoration penalties.

Operational Impact on Banking

In 2026, the most immediate impact of non-compliance is the banking freeze. UAE banks utilize automated monitoring to check the status of RAK ICC entities. If a company’s status in the registry changes to “Expired” or “In Default,” the bank will likely freeze all incoming and outgoing transactions within 24-48 hours. This can lead to defaulted contracts, missed payrolls, and severe reputational damage.

Master RAK ICC Compliance Checklist

To ensure your entity remains fully compliant throughout 2026, utilize the following RAK ICC compliance checklist as your internal governance standard.

Phase 1: Preparation (90 Days Before Anniversary)

- Document Audit: Check if any shareholder/director passports are expiring within 6 months.

- Activity Verification: Confirm if the business activity in the MOA matches actual operations (vital for bank-readiness).

- Financial Records: Ensure all transaction documents for the past year are digitally archived.

Phase 2: RBR & UBO Refresh (60 Days Before Anniversary)

- UBO Declaration: Re-verify that no natural person has acquired 25% or more control.

- Address Proof: Collect a utility bill or bank statement dated within the last 60 days.

- UAE Point of Contact: Confirm the current UAE resident contact is still available, and their Emirates ID is valid.

Phase 3: Renewal Submission (30 Days Before Anniversary)

- Agent Instruction: Provide written authority to the Registered Agent to proceed with the renewal.

- Fee Payment: Settle the registry and agent fees to ensure submission before the grace period ends.

- Tax Confirmation: Check if the Corporate Tax registration (TRN) is active and current.

Phase 4: Post-Renewal Verification (After Anniversary)

- Certificate of Good Standing: Request a fresh certificate for your bank and suppliers.

- Bank Notification: Inform your relationship manager that the renewal is complete to prevent automated freezes.

Case Study: RAK ICC Compliance Support for 2026

Client Scenario

A RAK ICC holding company with a layered ownership structure and an active UAE bank account was approaching its 2026 renewal. The Registered Agent flagged gaps in RBR and UBO records, while the bank requested updated ownership disclosures.

How DBTA Helped

DBTA reviewed the company’s structure, clarified the correct UBO position, prepared clear ownership and control documentation, and coordinated updates with the Registered Agent. KYC records were refreshed and aligned to both registry and banking expectations ahead of the renewal.

Result

The company renewed on time, RBR and UBO records were accepted without follow-up, and banking operations continued without disruption.

Client Testimonial

“DBTA made the compliance process clear and manageable. Everything was handled early, and our renewal and banking reviews were completed without issues.”

How DBTA Helps

Navigating the complexities of RAK ICC compliance requirements in 2026 requires more than just a service provider; it requires a strategic partner with deep institutional knowledge of the UAE regulatory landscape. At Dubai Business and Tax Advisors (DBTA), we provide an expert-led compliance architecture designed to “future-proof” your offshore investments. Rather than reacting to issues as they arise, we focus on building clarity and consistency into the compliance process, so clients are not caught off guard during renewals, audits, or bank reviews.

FAQ's:

In 2026, RAK ICC compliance mainly revolves around three areas: annual renewal of the company, keeping ownership and control records up to date (RBR and UBO), and completing yearly KYC checks through the Registered Agent. Compliance is not a one-time task; it is an ongoing confirmation that the company structure, documents, and records still reflect reality.

The RBR process involves identifying all individuals who ultimately own or control the company, even if that control is indirect. This information is maintained by the Registered Agent and reviewed during renewals or when changes occur. The focus is on understanding how control works in practice, not just who appears on share certificates.

The renewal deadline depends on the company’s incorporation anniversary. Most companies are expected to start the renewal process several weeks before expiry to avoid delays. Waiting until the last moment often leads to complications, especially if additional documents or clarifications are requested.

RBR submissions are handled entirely through the Registered Agent. Company owners do not file directly with the registry. The Agent collects the required details, verifies them, and maintains the register as part of the company’s compliance records.

UBO requirements focus on identifying the natural person who ultimately owns or controls the company, typically at or above the 25% threshold. Even where ownership is layered through other companies, the individual at the top must be disclosed accurately and kept up to date.

The most effective way is to review ownership and control regularly, not just at renewal time. Any changes, share transfers, new directors, or restructuring should be communicated to the Registered Agent promptly so that records can be updated without last-minute pressure.

Missing the deadline can result in the company being marked non-active, which often triggers follow-up issues. These may include delayed reinstatement, additional fees, and increased scrutiny from banks. In more serious cases, prolonged non-renewal can affect the company’s legal standing.

Typically, this includes updated identification documents for shareholders, directors, and beneficial owners, proof of address, and any supporting documents required for RBR or UBO updates. If there have been changes during the year, additional documentation may be requested.

Late or incomplete RBR records can lead to compliance delays and may attract penalties depending on the circumstances. In practice, the bigger risk is disruption, renewals slow down, banks raise questions, and additional reviews are triggered.

Renewal costs usually include the registry fee and the Registered Agent’s service fee. The total amount can vary depending on whether updates, amendments, or additional compliance work are required. Companies with clean, well-maintained records generally face fewer add-on costs.

UBO updates are made through the Registered Agent. Whenever there is a change in ownership or control, the updated details must be provided along with supporting documents so the records can be amended accurately.

In most cases, renewal will not be completed until RBR records are in order. The Registered Agent must be satisfied that all compliance requirements have been met before proceeding with the renewal submission.

A practical checklist usually includes confirming renewal dates, reviewing ownership and control, updating KYC documents, checking RBR and UBO records, and ensuring accounting records are properly maintained. Addressing these points early reduces last-minute issues.

Non-compliance can lead to delayed renewals, penalties, increased scrutiny from authorities, and complications with banking relationships. Over time, repeated non-compliance may put the company’s continued operation at risk.

Preparation starts with organization. Review your company structure, confirm whether any changes occurred during the year, gather updated documents early, and coordinate with your Registered Agent well before the renewal date. Companies that plan usually complete the process smoothly.

Conclusion

In 2026, RAK ICC compliance is no longer a once-a-year task. Renewals, RBR records, and UBO disclosures now work together to determine whether a company remains active, bankable, and operational. Small oversights can quickly turn into delays or unnecessary scrutiny. In practice, companies that stay organised, update changes early, and treat compliance as part of regular governance experience far fewer issues. Those who leave it to the last minute often face avoidable complications. RAK ICC continues to offer a strong framework for international structures, but only when compliance is handled proactively. A consistent, well-managed approach remains the most reliable way to protect the company and keep it functioning smoothly.

About the Author:

AURANGZAIB CHAWLA

As CEO of DBTA, Aurangzaib Chawla advises globally mobile businesses and individuals on cross-border tax planning and structuring. With expertise spanning the UK, UAE, and wider GCC, Zaib helps clients minimise double taxation, protect assets, and achieve long-term financial efficiency while staying fully compliant.

Planning to launch in Dubai or the UAE?

Let’s talk about how to structure your business for growth the smart, compliant, and tax-efficient way

About the Author:

AURANGZAIB CHAWLA

As CEO of DBTA, Aurangzaib Chawla advises globally mobile businesses

and individuals on cross-border tax planning and structuring. With expertise spanning the UK, UAE, and wider GCC, Zaib helps clients minimise double taxation, protect assets, and achieve long-term financial efficiency while staying fully compliant.

Planning to launch in Dubai or the UAE?

Let’s talk about how to structure your business for growth the smart, compliant, and tax-efficient way.