Dubai Company Setup, Tax Planning, Finance Strategy

From Company Formation to Financial Mastery, All Under One Roof

At Dubai Business & Tax Advisors (DBTA), we go beyond paperwork. As your trusted business tax advisor and setup partner, we guide you through every stage of establishing your company in Dubai, from business license in Dubai or Abu Dhabi, to corporate bank account opening, to tax and compliance advisory services. Our seasoned consultants ensure your structure is efficient, compliant, and ready for growth, helping you unlock business tax benefits, reduce risk, and achieve long-term success.

Business Strategy | Company Formation | Tax & Compliance | Finance & Growth

Process of Business Setup in Dubai and the UAE

At Dubai Business & Tax Advisors (DBTA), we simplify the journey of setting up your company in Dubai. Our ACCA-qualified team ensures every step, from choosing the right business license in Dubai to opening a corporate bank account, is structured, compliant, and aligned with your long-term goals.

Select the Right Jurisdiction

Choosing the correct jurisdiction is the foundation of a successful business setup. We assess your objectives to recommend Mainland, Free Zone, or Offshore structures that deliver maximum small business tax benefits, efficient compliance, and international credibility. With DBTA, you avoid costly mistakes and build on the right footing from day one.

Prepare Your Documents

Our experts handle all documentation with precision, from MoA drafting to shareholder agreements and notarisation. By ensuring every requirement is met under UAE tax and compliance advisory services, we eliminate delays and keep your incorporation process seamless.

Get Your Business License

Whether it’s a business license in Abu Dhabi, Dubai Free Zone permit, or specialized professional license, we guide you through selecting the right activity codes and approvals. Our licensing consultants ensure regulatory compliance while aligning the license with your future expansion plans.

Process Your Visa

Navigating visa processing in Dubai can be complex. We streamline employee and investor visas, Emirates ID, and medicals while ensuring compliance with WPS and labour regulations. With DBTA, your workforce transitions smoothly and legally under one roof.

Open a Corporate Bank Account

Opening a bank account in Dubai is often the most challenging step. We liaise directly with banks, prepare compliance packs, and address KYC/AML concerns. By leveraging our banking network, we help you access reliable financial partners for smooth operations and cross-border trade.

How DBTA Supports

Smarter Business Decisions

Watch this short video to see how DBTA identifies risks, enhances transparency, and protects businesses explained simply in under 60 Second.

Select Your Jurisdiction

Mainland Company Setup

- Choose this to serve UAE customers and operate across the local market.

- Best for flexible activities and broader commercial access.

- Often needs office/tenancy and required approvals.

Free Zone Company Setup

- Choose this for a package-based setup under a Free Zone authority.

- Best for services, trading, tech, and e-commerce models.

- Comes with facility options (desk/office where applicable) and authority rules.

Offshore Company Formation

- Choose this for holding and structuring (assets, shares, IP).

- Best for international ownership, not direct UAE trading.

- Requires registered agent support and KYC-ready documents.

How Much Does It Cost to Set Up a Business in Dubai?

The cost of business setup in Dubai usually starts from AED 12,000, but many factors influence the final total. Licence & registration fees vary by jurisdiction, free zone licences often run AED 10,000–50,000+, while mainland setups may add extra regulatory charges.

Office space (flexi-desk, dedicated offices) and visa/immigration (investor, employee) costs further impact the budget. Special approvals or regulated activities may raise costs even more. At Dubai Business & Tax Advisors, we break down these costs transparently based on your structure, whether you need a business license in Dubai, license consulting services, or integrated tax & compliance support.

Why Choose DBTA for Your Business Setup Needs?

At Dubai Business & Tax Advisors (DBTA), we don’t just help you start a business, we ensure it thrives. From selecting the right jurisdiction to securing your business license in Dubai, preparing shareholder agreements, and ensuring ongoing tax and compliance, our team manages the entire journey with precision and care.

We keep your setup stress-free by staying ahead of regulatory updates, filing deadlines, and audit and compliance requirements, so you can focus on growing your company. Whether you’re launching a startup, scaling an SME, or expanding internationally, DBTA provides a one-stop solution that combines legal setup, corporate finance consulting, and day-to-day compliance under one roof.

- Diverse Industry Experience

- Personalized Advisory Approach

- Transparent Pricing & Clear Guidance

All-In-One Business Setup & Advisory Services

From incorporation to strategic growth, DBTA provides full support across tax & compliance, accounting, auditing, corporate finance, property, licensing & PRO, and international structuring, all under one roof.

Internal Audits

Conduct comprehensive internal financial audits to assess controls, detect inefficiencies, and strengthen risk frameworks across operations, helping ensure governance, transparency, and decision-ready data.

Statutory Audit

Perform independent audits of company accounts according to UAE law, confirming compliance, financial truth, and credibility to regulators, shareholders, and external stakeholders.

Forensic Audit

Carry out targeted forensic investigations into suspected fraud, irregularities, or financial misconduct, producing court-ready reports with documented findings and actionable conclusions.

IT & System Audits

Review your IT infrastructure, system controls, cybersecurity, and data integrity to ensure systems support compliance, security, and audit readiness.

Compliance & Risk Audits

Evaluate adherence to regulatory, ESR, and AML obligations; identify gaps; recommend remediation strategies to protect from penalties and reputational damage.

Bookkeeping & Cloud Close

Prepare accurate, monthly books using cloud tools (Xero/QuickBooks), reconcile transactions, and deliver real-time dashboards for informed decision-making.

AP/AR & Payroll

Manage accounts payable, receivable cycles, and payroll processing, ensuring timely payments, correct calculations, and smooth cash-flow operations.

Financial Statements

Compile audited financial statements in line with IFRS standards, ready for shareholders, investors, regulators, or audit review.

Budgeting & Forecasting:

Develop rolling budgets, scenario models, and forecasts for strategic planning, enabling scenario comparisons and proactive business decisions.

Corporate Tax Advisory

Provide ongoing advice on structuring, tax optimization, and compliance under UAE and cross-border regimes, maximizing benefits while mitigating risks.

VAT Advisory & Filing

Manage VAT registration, returns, compliance reviews, audits, and advice on vat advisory services in Dubai to keep your business fully aligned.

Transfer Pricing & ESR

Plan, document, and defend transfer pricing arrangements and ESR compliance in line with regulations, ensuring robust intercompany structure.

Expat & Personal Taxes

Design tax strategies for expatriates, dual residents, and overseas landlords, optimizing residency, inheritance, and liability under UK/UAE rules.

Debt & Capital Advisory

Structure debt and equity rounds, prepare lender packs, negotiate terms, and position your business for scalable capital access.

Debt Analysis & Restructuring

Analyze existing obligations, restructure liabilities, improve cash position, and relieve financial pressure while preserving operational continuity.

Valuation & Treasury Management

Provide independent valuations, cash-management frameworks, and treasury oversight to strengthen your financial foundation.

Strategic Planning & CFO Services

Deliver virtual CFO support, financial leadership, scenario planning, KPI tracking, and strategic advisory to guide growth.

Property Acquisition

Source, evaluate, negotiate, and complete real estate acquisitions aligned with your strategic goals and investment criteria.

Property Leasing

Manage tenant selection, lease drafting, negotiations, and compliance to optimize rental income and lease stability.

Real Estate Advisory

Design portfolio strategy, SPV setup, exit planning, and alignment of property assets within overall tax and structure goals.

Business License Support

Assist with license selection, approvals, and renewal across Dubai and Abu Dhabi, tailored to your business model and growth path.

Trade License Management

Oversee activity approvals, structuring, trade-code alignment, amendments, and renewal processes for seamless compliance.

Visa & PRO Services

Handle all government liaison: investor/employee visas, Emirates ID, medicals, attestations, and regulatory follow-ups.

Free Zone Setup:

Choose and incorporate in optimal free zones, optimizing for substance, tax efficiency, and expansion flexibility.

Cross-Border VAT / OSS / EORI:

Integrate UAE operations with EU/UK trade, manage vat advisory in Dubai, OSS filings, and EORI/marketplace setup.

Banking & Payments:

Facilitate bank account opening, KYC packages, payment gateway integration, and cross-border transaction infrastructure.

Substance & Residency Planning:

Plan and implement substance, TRC, and cross-border residency strategies to optimize tax exposure and compliance.

Financial Control That Grows with Your Business

Growth in Dubai moves fast. Financial structure must move faster. Many companies scale revenue but lose visibility over cash, costs, and compliance. That is where structured Finance Manager Services make the difference.

A full-time Finance Manager in Dubai often costs AED 30,000 to AED 45,000 per month. For many SMEs, that investment feels heavy. Yet 52% of UAE small businesses report ongoing cash flow stress. Most problems begin with weak reporting and poor forecasting.

DBTA provides senior-level financial oversight without the full-time commitment. Our Business Finance Manager support brings structure to financial reporting, disciplined month-end closing, and reliable cash flow forecasting in Dubai. You see what is happening before it becomes a risk.

Strong financial structure also improves investor confidence. Studies show that nearly 60% of startup failures relate to financial mismanagement. We focus on clear reporting, risk management in Dubai, and practical financial strategy that supports steady growth.

If your business needs clarity, control, and forward planning, our Finance Manager services in Dubai deliver experienced leadership with measurable impact.

Structured Financial Reporting

Cash Flow Forecasting

VAT-Aligned Financial Controls

Strategic Financial Planning

Structured Financial Reporting

Cash Flow Forecasting

VAT-Aligned Financial Controls

Strategic Financial Planning

About Dubai Business & Tax Advisors

A team of UK-qualified accountants, auditors, and tax consultants operating out of Dubai, DBTA merges local regulatory mastery with international structuring expertise. We guide businesses through complex UAE compliance, tax and business planning, and cross-border structuring, delivering clarity, confidence, and sustainable growth in every engagement.

Strategic Guidance

Our business tax advisor and senior consultants provide deep, personalized direction, from corporate setup through business tax planning, compliance assessments, and ongoing advisory, so your decisions are grounded in insight, not guesswork.

International & Local Credibility

Led by UK-trained leadership, DBTA embodies professional standards recognized globally. We speak both UAE regulatory language and international tax frameworks, making us your bridge between local compliance and strategic cross-border structuring.

Comprehensive Service Coverage

Whether your business needs audit & assurance, accounting & bookkeeping, corporate finance consulting, property investment advice, or licensing & PRO, we deliver integrated support, with one trusted point of contact to streamline your operations and eliminate fragmentation.

What Our Clients Achieve with Expert Tax & Business Consulting

At DBTA, our work isn’t just compliance, it’s transformation. Clients partner with us to gain financial clarity, tax efficiency, robust structures, and growth foundations tailored to their business goals.

Lower Effective Tax Rates:

Through strategic business tax planning, cross-border structuring, and legitimate reliefs, clients often reduce their tax burden by double-digit percentages while remaining fully compliant.

Investor-Ready Financials:

We deliver audited, transparent accounts, governance controls, and structured reporting packages that position clients to raise capital, secure loans, or scale with confidence.

Scalable Systems & Control:

By embedding automation, internal controls, dashboards, and monitoring tools, we ensure your finance function evolves smoothly as your business grows, not creates bottlenecks.

Latest Blogs Post

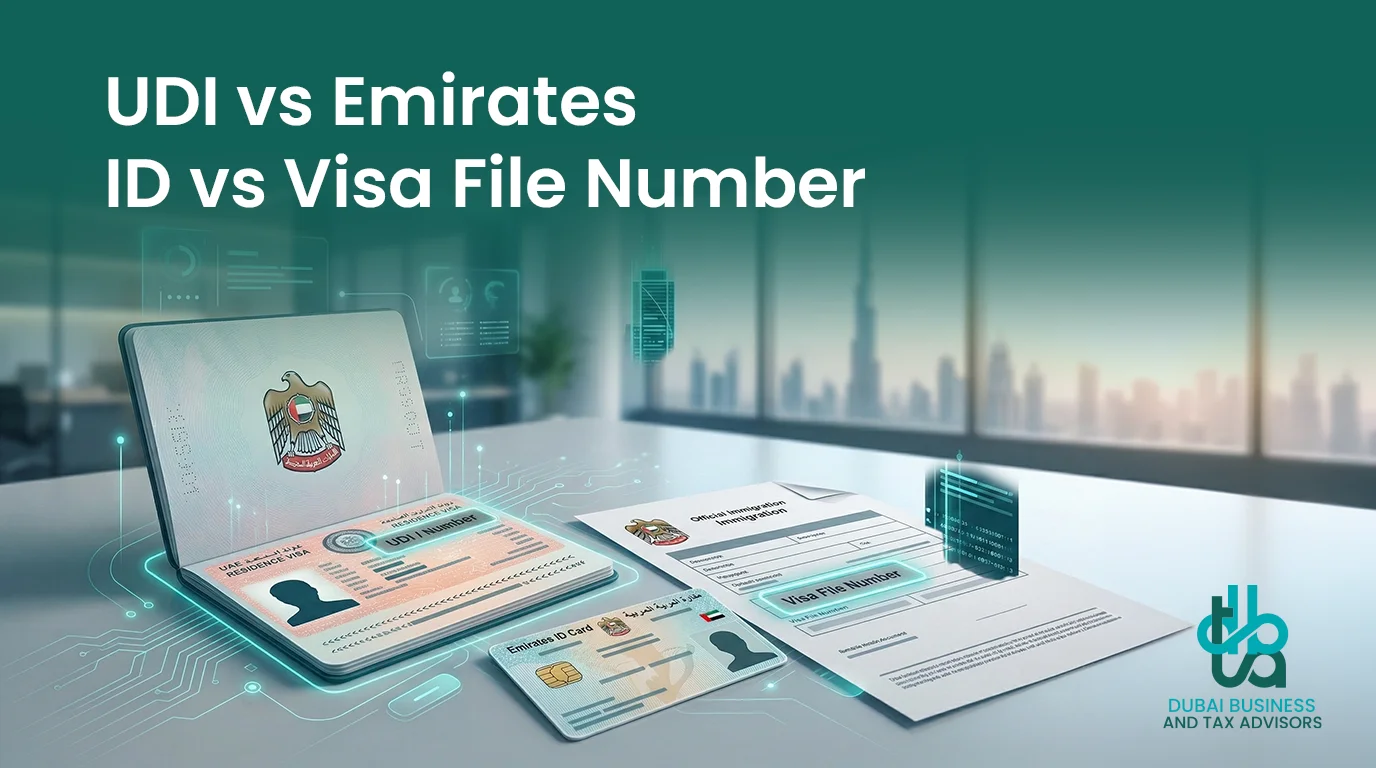

UDI vs Emirates ID vs Visa File Number: What’s the Difference (and Which One Banks Ask For)

Read More »Our Trusted Partners

UAE Business Setup - FAQs

What is the process for business setup in Dubai and how long does it take?

First, pick how you want to operate, mainland, free zone, or offshore, then secure your company name. After that comes getting official okay’s, alongside your license, plus visa. Usually, a simple start-up runs between five to ten workdays, though this shifts based on what you do, where you are, and if your paperwork is prepared.

How do I decide between mainland, free zone or offshore setup for my business?

It depends on where you set up shop, which hinges on how your business works, where you sell things, taxes, also what permits you need. The mainland lets you trade within the UAE. Free zones mean lower taxes plus easier importing/exporting. Offshore options might give you more privacy. We figure out what fits your plans, especially when it comes to taxes.

Can a foreigner own 100 percent of a company in the UAE?

These days, the UAE lets foreigners completely own businesses, particularly within free zones or for ventures fitting new regulations. Though establishing a company on the mainland might necessitate a local partner, we can help organize your business so it obeys the law while achieving what you want regarding ownership.

What documents do I need to submit to form a company in Dubai?

Generally, gather your passport, something showing where you live, bills work, a letter from your bank or a resume. For companies, include formation documents alongside information about owners plus investment. Depending on what your company does, further permissions might demand credentials or verified paperwork.

How much does business license in Dubai cost and what factors affect that cost?

Licence expenses depend on where you’re located, what your company does, how many visas you require, also if you need an office. Generally, basic licences begin around AED 10,000 to 15,000; however, specialized or heavily controlled businesses may incur higher charges. You’ll receive a straightforward price list from us beforehand.

Do I need a physical office address when I register a company in Dubai?

Yes, most jurisdiction rules require a physical address or flexi-desk to satisfy licensing requirements. Some free zones let you operate virtually or use a shared workspace initially. We help arrange compliant office solutions so you meet license consulting services standards.

Can you help me with trade license renewal each year?

Absolutely. We manage trade license renewal, keeping track of expiry, preparing the paperwork, dealing with regulatory compliance, and submitting all requirements so your operations continue smoothly, no gaps, no penalties.

What is Dubai instant license service and who is eligible for it?

The Dubai instant license service is a fast-track process for certain business types (e.g., e-commerce, consultancy) that lets you start operations almost immediately. Eligibility depends on activity category and regulatory approvals, DBTA helps you check if your business qualifies.

How many visas can I get under my business setup in Dubai?

Visa entitlement depends on your licence type, office size, and jurisdiction. Some free zones offer a few visas with base licence; expanding requires more office space or paid additions. We guide you to maximize visa allocation while staying compliant.

What is the benefit of using a business setup consultant versus doing registration myself?

A setup consultant ensures you choose the right jurisdiction, understand hidden fees, manage approvals, and avoid delays. You get strategic advice, cost clarity, local compliance knowledge, and peace of mind, making your launch smoother and legally sound.

What is the current corporate tax rate in the UAE?

Starting June 1, 2023, UAE corporate profits up to AED 375,000 are taxed at 0 %. Above that amount, the rate is 9 %. DBTA helps you plan around this threshold to ensure optimal business tax planning and compliance.

Who must register for corporate tax in the UAE?

Any entity or person earning UAE sourced business profits and meeting the registration threshold must enroll for corporate tax. We guide you in determining whether your business is a taxable person under UAE rules.

Will a free zone company be taxed under corporate tax rules?

Free zone companies can benefit from 0 % tax on qualifying income if they satisfy substance and compliance requirements. But non-qualifying income or failure to meet conditions can trigger a 9 % tax exposure.

How do I comply with VAT rules and file returns in Dubai?

Once your taxable supplies and imports exceed the threshold, you need to register for VAT, file returns quarterly, maintain records, and meet vat compliance in Dubai requirements. We handle the process end to end.

When must I register for VAT in the UAE?

You must register when your taxable supplies and imports exceed AED 375,000 annually. Voluntary registration is possible from AED 187,500. DBTA helps you evaluate eligibility and manage your vat advisory in Dubai registration.

What penalties apply if I miss VAT filing deadlines?

Penalties include AED 1,000 or more for late returns, extra fines, and interest on unpaid VAT. Failing to register when required can incur fines up to AED 10,000. We monitor your filings and alert you to avoid penalties.

Can I deduct business expenses under UAE corporate tax rules?

Yes, you can deduct legitimate, wholly business-related expenses. Costs must be properly documented and supported. The general anti abuse rule ensures deductions reflect commercial reality. DBTA optimizes expense claims while remaining compliant.

How does transfer pricing affect UAE companies?

Transfer pricing governs pricing of intercompany transactions. UAE entities must document and justify these to ensure they align with the arm’s length principle. DBTA provides tax compliance and advisory services to structure transfers correctly.

How do I register for both corporate tax and VAT together?

You’ll apply separately via UAE’s tax portal for corporate tax and through FTA for VAT. DBTA helps coordinate these processes so your tax and compliance advisory services streamline documents, registrations, and deadlines.

What are tax compliance and advisory services and how can they help?

These services include planning, filing, audit assistance, regulatory liaison, and strategic structuring. DBTA turns provisions into clear actions, reducing risk and enabling business tax planning that aligns liability with your growth goals.

What is the difference between internal audits and statutory audits?

An internal audit is a review conducted by or for the company to improve controls, operations, and risk management. A statutory audit (or external audit) is required by law to validate the truth and fairness of financial statements. Together they help reinforce trust and compliance.

How often should a business undergo audit of company accounts?

Typically, companies are required to have a statutory audit annually. Some also opt for internal audits quarterly or semiannually for control checks. The frequency often depends on your size, regulatory requirements, and risk exposure.

What are the benefits of hiring forensic audit services?

A forensic audit uncovers fraud, misappropriation, or financial irregularities by examining transactions in detail and producing robust evidence. It helps protect reputation, recover losses, and deter future wrongdoing.

Can you provide internal audit services in Dubai and Abu Dhabi?

Yes. We offer internal audit services in Dubai and internal audit services in Abu Dhabi, assessing your internal controls, compliance, and risk frameworks to help you strengthen governance.

What is involved in IT and system audits for small companies?

An IT & system audit reviews software, controls, cybersecurity, access logs, data integrity, backups, and change management. It ensures your systems support accurate operations and financial reporting.

How do you prepare financial statements for audits in the UAE?

We collate your accounts, reconcile ledgers, validate supporting documents, adjust accruals, and format statements under IFRS. Then we review internally before handing over to external auditors for formal validation.

What role does an audit and compliance consultant play in my business?

An audit and compliance consultant designs audit programs, ensures regulatory alignment, identifies control gaps, and advises on remediation. They act as a bridge between your operations and external standards.

How does book keeping & accounts payable/receivable work for new businesses?

We record all transactions, reconcile bank accounts, manage vendor and customer invoicing cycles, and ensure accurate coding. This clean bookkeeping is the basis for audit of company accounts and compliance.

What does budgeting and forecasting achieve for growing companies?

Budgeting and forecasting let you estimate revenue, plan expenses, and test scenarios. This provides a roadmap for growth, guides strategic decisions, and helps identify funding or efficiency needs.

How do I ensure my business records pass a VAT audit services in Dubai review?

Maintain original invoices, reconcile with VAT returns, keep accurate ledgers, track taxable amounts and exemptions, and regularly validate your internal records. A clean, transparent audit trail increases success during vat audit services in Dubai.

What kind of debt and capital advisory services do you provide?

We assist clients in structuring equity and debt raises, preparing lender pitches, negotiating terms, and helping access banking, venture or private capital. Our debt and capital advisory ensures you secure growth funding aligned with your strategy and risk appetite.

How do I evaluate whether to take a consolidation loan in the UAE?

We perform a debt analysis to compare your interest costs, cash flow impact, and repayment schedule. We model scenarios and counsel you on debt consolidation loan UAE versus refinancing, so your decision supports long-term financial health.

How is a business valuation determined for investors or sale?

Valuation is based on revenue multiples, EBITDA, growth prospects, and comparable company analysis. We also assess asset value, market conditions, and risk. Our valuations help guide negotiations, acquisitions or exits with confidence.

What does outsourced CFO service include for SMEs?

Our outsourced CFO service provides strategic financial leadership, budgeting, forecasting, KPI tracking, capital planning, cash management and board reporting. You get senior expertise without the overhead of a full-time hire.

How do I secure trade finance compliance for international transactions?

We help you navigate trade finance compliance by structuring letters of credit, guarantees, foreign exchange hedging, and documentation. We ensure processes meet banking, regulatory and tax rules, reducing risk in cross-border trade.

What is the difference in getting a business license in Abu Dhabi versus Dubai?

Licensing authorities differ and fees vary. Business license in Abu Dhabi may require different approvals, local office norms, and costs compared with business license in Dubai setups. We guide you through optimal jurisdiction selection.

What is involved in licence consulting services for new businesses?

We guide clients through license application, approval, activity selection, structuring, and renewal. Our license consulting services ensure your required permissions, trade codes and corporate structure align with regulatory needs and long-term goals.

How does visa & PRO integration simplify my operations?

By bundling visa & PRO services, we manage investor and employee visa processing, labour cards, Emirates ID, document attestations, renewals and government liaison, freeing you to focus on running your business smoothly.

Can DBTA help international clients set up in UAE free zones?

Yes. Our advisory includes international clients operating in UAE free zones, we advise on company formation, cross-border tax structuring, banking, VAT and corporate tax obligations, tailored to your jurisdiction and activity.

How do you structure cross border tax and business planning for UAE-UK operations?

We build integrated structures for UAE and UK entities, optimizing business tax planning, managing transfer pricing, treaty benefits, and residency issues. Our cross-border frameworks aim to minimize liabilities while maintaining legal compliance.

Connect with Reliable Dubai Business Consultants

Certified Chartered Accountants

Be stress-free with top-tier accounting and financial expertise in Dubai.

Ensure Data Confidentiality

Using advanced accounting technology and controls for data security.

Achieve Measurable Results

Making sure your financial strategy aligns with your goals and objectives.