Business Setup in Dubai Mainland: DED Steps & Costs (2025 Guide)

Recent Insights

Table of Contents

Introduction

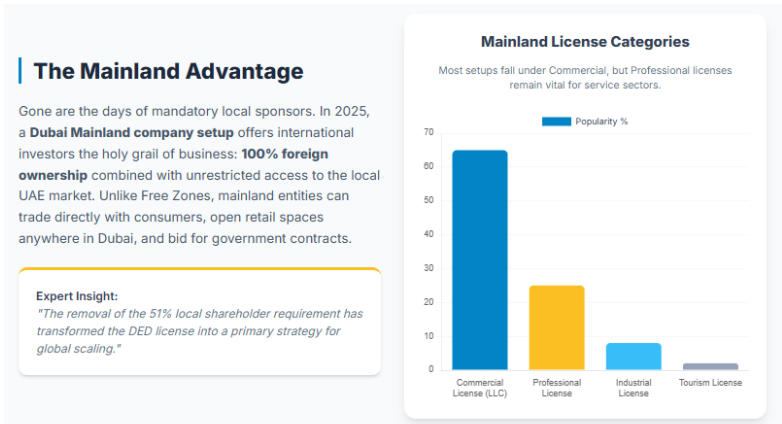

For decades, investors choosing Dubai faced a critical trade-off: market access (mainland) versus 100% ownership (Free Zone). This structural compromise is now obsolete. The biggest shift in the UAE’s corporate environment is the sweeping change to foreign ownership rules, making business setup in Dubai mainland the definitive choice for serious, scaling enterprises in 2025.

A mainland company, registered with the DED/DET, is an onshore path. It acts as the “golden ticket,” granting unrestricted access to conduct business across the entire UAE, from securing high-value government contracts to opening retail stores in major malls. Critically, the removal of the mandatory 51% national shareholder means 100% foreign ownership is now widely available on the mainland. This positions the mainland business setup in Dubai as a primary, strategic platform for global companies seeking full market penetration and corporate governance control.

This guide is built for founders and executives whose ambitions push beyond Free Zone limits. While ownership is simplified, the process still requires precision. Investors struggle with predicting the DED company’s setup process costs, securing clear visas, and mastering stringent new compliance rules like Corporate Tax. Our promise is a transparent, experienced roadmap that converts the theoretical Dubai mainland license steps into predictable, informed executive decisions.

What is Mainland Business Setup in Dubai?

A business setup in mainland Dubai operates under the direct supervision of the DED/DET, meaning it adheres to the civil laws and commercial codes of the UAE Federal Government and the Emirate of Dubai. Unlike Free Zone entities, the mainland provides a license to trade without geographical limitation across all seven Emirates.

The primary benefit of a Dubai mainland company setup is unrestricted access to the local market, including opening retail spaces, engaging B2C sales, and bidding on government tenders. The structure now widely permits 100% foreign ownership.

The DED classifies activities into three main license types, which dictate the legal structure and fee components:

- Commercial License: For trading activities (LLC structure), often allowing 100% foreign ownership. This is required for general trading, import/export, retail, and logistics.

- Professional License: For intellectual services (consultancy, IT, legal). This secures 100% foreign ownership but requires the appointment of a UAE national as a Local Service Agent (LSA). The LSA role is strictly administrative and non-equity holding.

- Industrial License: Mandated for manufacturing and production activities.

Selecting the correct license type and activity code is the foundation of a successful setup and determines the DED license cost for 2025 and the regulatory framework.

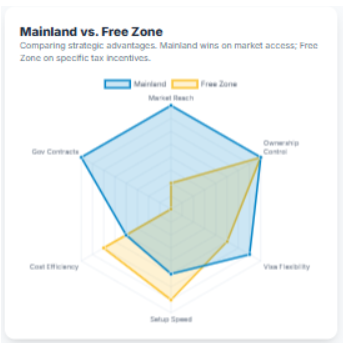

Mainland vs Free Zone vs Offshore (Comparison)

Choosing the correct jurisdiction is the single most important strategic decision an investor makes. The choice must align precisely with the company’s intended market access, physical needs, and risk profile.

- Mainland (Onshore): The jurisdiction of choice for businesses whose primary market and revenue source are within the UAE. It mandates a physical office but grants unrestricted local access.

- Free Zone: Ideal for companies focused on international trade, manufacturing for export, or specific sector hubs (e.g., technology in DIC). Free Zone companies cannot trade directly within the mainland unless they appoint a local agent or open a mainland branch. Free Zones are physically defined economic areas with special benefits.

- Offshore: Used purely for asset protection, international invoicing, or holding purposes. Offshore entities cannot rent offices, hire staff, or conduct any operational business within the UAE. For more details on this, explore our guide on offshore company setup.

A critical point of differentiation in 2025 is corporate taxation. While Free Zones historically offered 0% tax, this rate is now conditional: it applies only to “Qualifying Income” and requires maintaining substantial economic presence. Conversely, the mainland offers a simple, tiered structure (0% up to AED 375,000 in taxable income, 9% above). For SMEs focused on local revenue, the predictable mainland tax structure, often with its lower threshold, can offer greater fiscal clarity than navigating the complex “Qualifying Income” definitions of a Free Zone.

Comparison of Jurisdictions (2025)

| Feature | Mainland (DED) | Free Zone | Offshore |

|---|---|---|---|

| Market Access | Direct trade across the entire UAE | Restricted to the free zone and international trade | Cannot conduct business within the UAE |

| Foreign Ownership | 100% (for most activities) | 100% | 100% |

| Physical Office | Mandatory (Ejari required, approx. 9m² per visa) | Flexible (Flexi/co-working allowed) | Not required in the UAE |

| Corporate Tax (CT) | 0% up to AED 375k, 9% above | 0% on Qualifying Income (substance required) | Exempt from UAE CT |

Case Study: Predicting Tax Liability

A European software firm was choosing between a Free Zone setup and a Dubai mainland company. They assumed the Free Zone’s 0% tax was better, but most of their revenue came from UAE mainland clients, meaning it would be taxed at 9% as non-qualifying income. We modelled their numbers and showed that the mainland structure, with 0% tax up to AED 375,000 and 9% only above that, offered a simpler and more predictable tax outcome.

Client Quote:

“DBTA’s financial modelling showed that once we factored in the 9% corporate tax on our projected local revenue, the simplicity of a tiered Dubai mainland company setup was the obvious choice.” —Mr. Liam O’Connell, CFO, TechStream Solutions.

Types of Mainland Business Licenses (DED Structure)

The DED classifies activities into several license categories, which dictate the legal structure, mandatory approvals, and eventual fees. Founders must accurately choose their activity first, as this selection influences nearly every subsequent requirement.

- Commercial License: The most common form, typically used for Limited Liability Companies (LLCs). Activities range from General Trading (requires higher initial fees) to specialized trading (electronics, automotive parts) and commercial services (logistics, real estate brokerage).

- Professional License (Civil Company/Sole Establishment): Dedicated to intellectual and technical services, such as management consultancy, software development, education services, and technical services. This arrangement allows foreign investors to maintain 100% ownership but requires a Local Service Agent (LSA) for administrative tasks.

- Industrial License: This License is assigned to manufacturers, preservers of food products, and industrial licenses where specific chemical and environmental regulations are applicable.

- Tourism License: For entities operating within the hospitality Industry (e.g., travel agency, hotel management, or cruise operator); usually involves dealing with Dubai Tourism.

- E-commerce: In reality, it is not a License but an activity that falls under a Commercial License (if you are trading goods) or a Professional License (if you are selling digital platforms or online subscription services).

Understanding which category your primary and secondary activities fall under is essential for calculating the true Mainland LLC setup cost and avoiding costly licensing amendments later.

Case Study: Managing the LSA Fee

A high-net-worth media consultant needed a Professional License and was concerned the Local Service Agent (LSA) might seek a percentage of the company’s revenue, impact his long-term profitability, and increase the effective Mainland LLC setup cost. We structured a comprehensive LSA agreement that clearly defined the LSA’s role as non-executive and non-equity-holding, and secured a fixed, annual retainer fee that was factored into the operating budget.

DED Company Setup Process (DETAILED)

While the official DED turnaround time for the license issuance itself is rapid (sometimes less than 60 minutes for instant licenses or 5–10 working days for regular licenses), the total timeline for market readiness is governed by sequential, external bureaucratic steps like notarization and securing a physical office (Ejari). Executing these Dubai Economic Department steps accurately is vital for efficiency.

Here are the 10 detailed Dubai mainland license steps for company registration:

Choose Business Activity & Structure

The first step is identifying the exact activity codes the business will undertake. This choice dictates the legal form (e.g., LLC, Civil Company) and confirms eligibility for 100% foreign ownership.

Choose Company Structure

This decision follows the activity choice. For example, trading activities require an LLC, while consultancy services typically use a Civil Company.

Reserve Trade Name

Submit three suggested names to the DED. The names must comply with stringent Dubai naming rules, avoiding religious references, abbreviations, or names already in use. Timeline: 1–2 days.

Obtain Initial Approval

This non-renewable certificate grants the DED’s permission to proceed with the legal formation. It is mandatory before drafting legal agreements. Cost: Approximately AED 150–500. Timeline: 2–3 business days.

Draft MOA/LSA

The MOA of an LLC or the LSA Agreement in case of a professional firm has to be executed. These are important legal documents that determine who can and cannot represent inside the movement.

Notarize MOA/LSA

The drafted agreements must be officially signed and attested by the Dubai Notary Public or relevant judicial body. This step requires the physical presence of all shareholders or their legally appointed Power of Attorney (POA) holder. Common Error: Failure to account for signatory travel or delays in obtaining valid POA documents. Timeline: This stage can take 1–2 weeks due to scheduling appointments and judicial queues.

Tenancy Contract & Ejari

A valid, physical commercial office space is a non-negotiable Dubai mainland requirement. The tenancy agreement needs to be registered with RERA, and you must get the Ejari certificate. Office size is directly connected to the quota of visas (about 9 m²/visa).

Submit Final Application

All Final Establishment Documents are submitted for mainland setup, including Initial Approval, notarized MOA/LSA, and Ejari certificate (If one is required), and any external approvals according to activity (health or transport).

Receive License

Upon successful final review, a payment voucher for the DED license cost 2025 is issued. Payment of this voucher within the designated 30-day window results in immediate issuance of the digital trade license.

Immigration, Labor File & Visa Issuance

The employer has to be registered with the Ministry of Human Resources and Emiratization (MOHRE) in order to establish a card, which is required for employee/investor visa stamping. The final stage is to apply for a two-year investor visa (for shareholders) and employment visas for employees.

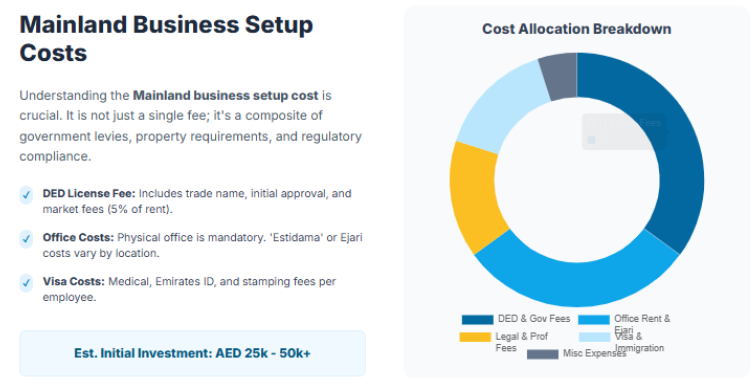

Dubai Mainland Business Setup Costs (2025)

Understanding the total Mainland business setup cost requires moving beyond the basic trade license fee and accounting for mandatory variable expenses, particularly property and professional fees. The estimated initial investment for a standard license range from AED 25,000 to AED 50,000+, excluding rent deposits and initial visa fees.

If you are seeking to reduce these startup costs significantly, you can review our guide for Low-Cost Business Setup in Dubai.

The actual Cost to open LLC in Dubai is heavily influenced by the nature of the activity and the mandatory office space. For example, professional licenses incur an annual Local Service Agent fee, adding to the recurring cost.

Estimated Dubai Mainland Company Setup Costs (2025)

| Cost Component | Type | Estimated Range (AED) | Notes |

|---|---|---|---|

| A. Government/DED Costs | |||

| Initial Approval & Name Reservation | Govt. Fee | 1,000 – 3,000 | Includes Trade Name and Initial Approval fees. |

| License Issuance Fee (Base) | Govt. Fee | 10,000 – 15,000 | Varies based on license type and activities. |

| Mandatory Fees (Chamber, Knowledge, Innovation) | Govt. Fee | 1,000 – 3,000 | Knowledge (AED 10) and Innovation (AED 10) are mandatory. |

| B. Office/Ejari Costs | |||

| Annual Office Rent (Small/Start-up) | Fixed/Recurring | 15,000 – 50,000+ | Minimum physical space is a DED license requirement. |

| Ejari Registration Fee & Housing Fee | Govt. Fee | Variable | Housing fee is 5% of annual rent. |

| C. Registration/Legal Fees | |||

| MOA Notarization/Attestation | Legal Fee | 1,500 – 5,000 | Judicial costs for signing. |

| Local Service Agent (LSA) Fee (Annual) | Agent Fee | 5,000 – 15,000 | Mandatory for most Professional Licenses. |

| D. Visa Costs | |||

| Investor Visa (per 2 years) | Immigration Cost | 3,500 – 5,000 | Total Dubai mainland visa cost (entry, status change, medical, EID). |

| Establishment Card | Govt. Fee | ~750 | Required to process visas. |

| E. Hidden Costs | |||

| External Department Approvals | Govt. Fee | 1,000 – 20,000+ | Specific sectors like F&B, Health, and Transport. |

The base DED license cost 2025 is usually between AED 10,000 and AED 15,000, but when mandatory variable fees, LSA retainers, and initial government charges are added, the total initial payment for a new business often exceeds AED 25,000 before the first rent instalment and visa applications.

Case Study: Budgeting for Rental Obligations

A New Retail Startup budgeted accurately for the DED fees but failed to factor in the high upfront cost of securing a commercial lease. In Dubai, commercial leases often require 1-3 months’ rent as a security deposit plus the first quarterly payment, placing immediate strain on working capital. We intervened early in the planning phase, integrating the required 12-month property commitment (including the deposit and agency fees) into their financial model before they began the steps to obtain the Dubai mainland license.

Client Quote:

“DBTA’s detailed breakdown showed the true Mainland business setup cost, allowing us to accurately budget for the initial 12-month property commitment and avoid cash flow issues.” —Muna Al Ali, CEO, HomeGoods Retail.

Documents Required

Document preparation is an area where initial mistakes lead to exponential delays in the DED company setup process. The DED operates with zero tolerance for incomplete or non-compliant paperwork.

The essential Documents for mainland setup include:

For Individuals (Shareholders/Managers):

- Initial Approval Receipt and Trade Name Reservation Certificate.

- Passport copies, Emirates ID copies (if resident), and current UAE visa page (if applicable).

- No Objection Certificate (NOC) from the current employer, if the individual is currently under an employment visa in the UAE.

- Attested Memorandum of Association (MOA) or LSA agreement.

- Attested copy of the tenancy contract (Ejari certificate).

For Corporate Shareholders (If the parent company is registering a subsidiary):

This is significantly more complex and often delayed due to international requirements:

- Legalized and attested copies of the Parent Company’s Certificate of Incorporation, Memorandum, and Articles of Association.

- Original Board Resolution, notarized and legalized by the UAE Embassy in the country of origin, explicitly authorizing the establishment of the Dubai subsidiary and naming the authorized manager.

- Valid Trade License or Letter of Good Standing.

The requirement for legalized documents, meaning they must be certified by the UAE Embassy in the home country and then by the Ministry of Foreign Affairs (MoFA) in the UAE, is a common pitfall. Generic notarization is often insufficient.

Case Study: The Legalization Pitfall

A US-based Tech Firm attempted to submit its parent company’s Certificate of Incorporation, which had been notarized in New York. The DED submission was immediately halted because the document lacked the required legalization of stamps from the UAE Embassy and the MoFA. We deployed a fast-track legalization service, collecting documents from the US, and managing the complex attestation chain in parallel with other Dubai economic department steps.

Dubai Mainland Visa & Quota Rules

In the mainland, the Ministry of Human Resources and Emiratisation (MOHRE) manages the visa quota system. While Cabinet Resolution No. 203 (2022) introduced clearer guidelines based on priority sectors, the ability to hire remains fundamentally tied to physical presence.

The critical rule in Dubai mainland company formation is the spatial requirement: licensing departments routinely apply a guideline of 9 square meters of physical office space per visa allocation.

- Initial Quota: A standard new mainland business typically starts with an allocation of 3 employee visas, provided the office space meets the 27m² threshold. Companies in high-priority sectors may start with up to 6 or 20 visas.

- Expansion: If a company needs to scale, it must prove it has leased a larger commercial office space (a new Ejari certificate) before MOHRE approves an increase in the visa quota.

The two-year investor and employment visas carry a high cost. The total Dubai mainland visa cost is composed of several fixed government fees: entry permit, status change (if applying inside the country), medical testing, Emirates ID issuance, and final visa stamping. The total cost for a two-year visa typically ranges from AED 3,500 to AED 5,000 per individual.

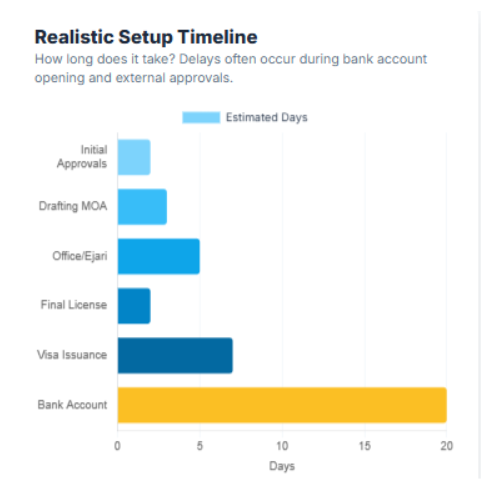

Timeline of Mainland Setup

Setting a realistic Mainland license timeline UAE requires distinguishing between the speed of digital government services and the necessary external, sequential steps.

The total process, from initial submission to being market-ready (with visas and a bank account), realistically spans 4 to 8 weeks.

- Licensing Phase (2–4 weeks):

- Initial Approval and Name Reservation: 3–5 working days.

- MOA Notarization: 1–2 weeks (depends heavily on signatory availability and judicial appointment queues).

- Ejari Registration: 2–5 days.

- Final License Issuance (after payment of Mainland trade license fees): 1–2 days.

- Post-Licensing Phase (2–4 weeks):

- Establishment Card Issuance: 5–10 days.

- Investor/Employee Visa Processing: 2–4 weeks.

- Banking Phase (2–6 weeks):

- Corporate account opening is highly variable and often the longest wait time in the entire setup process.

The primary risk to the DED company setup process timeline is not DED inefficiency but delays in securing external approvals (if required for specific activities) or bureaucratic bottlenecks like banking compliance and MOA notarization.

Case Study: Mitigating Banking Delay Risk

An E-learning Platform secured its license quickly (7 working days via a quick license process) but was immediately frustrated by bank application queues and due diligence, which took over five weeks. We prepared the client for this common delay, integrating the banking phase into the overall project plan from the outset and advising them to use existing international invoicing channels temporarily while awaiting local account finalization.

Banking for Mainland Companies

Securing a corporate bank account is frequently the most challenging phase after obtaining the business setup in a mainland license, primarily due to heightened compliance and Anti-Money Laundering (AML) requirements under Federal Decree Law No. 10 of 2025.

Banks conduct intense due diligence, and rejections are common if the company file is not robust.

Common Reasons for Bank Account Rejection:

- Lack of Local Economic Substance: Banks prioritize companies that show a genuine presence, a physical office, employment visas, and evidence of local utility bills.

- Opaque UBO Structure: Failure to clearly identify and verify the Ultimate Beneficial Owner (UBO) through every layer of corporate structure raises red flags.

- Inconsistent Documentation: Mismatched names or addresses across the trade license, MOA, Ejari, and passport create immediate compliance errors.

- High-Risk Activity/Geography: Certain sectors (e.g., cryptocurrency, complex import-export, or dealings with scrutinized jurisdictions) attract enhanced checks.

Most banks require new corporate accounts to maintain an average minimum balance, often ranging from AED 50,000 to AED 500,000, depending on the chosen package.

UAE SME-Friendly Bank Options:

Certain financial institutions, such as the Commercial Bank of Dubai (CBD) through their Starter accounts, offer packages specifically designed for newly established SMEs and startups, often with ZERO balance requirements and simplified documentation.

Case Study: UBO Chain Complexity

An IT Consultancy with a complex ownership chain (a subsidiary of a holding company that was owned by a trust in Europe) was rejected twice by major UAE banks due to an inability to clearly evidence the ultimate beneficial ownership. We intervened, prepared bank-specific UBO flowcharts, acquired legal attestations verifying the trust structure, and confirmed identity documentation for all parties in the chain.

Mainland Compliance Requirements (2025)

The era of simple licensing is over. Today, post-setup compliance is mandatory, sophisticated, and applicable to nearly all mainland entities.

- Corporate Tax (CT): Mandatory for all mainland businesses. The UAE implements a tiered tax rate: 0% for taxable income up to AED 375,000 and 9% for taxable income exceeding that threshold.

- Filing Requirement: All companies must register with the Federal Tax Authority (FTA). Returns must be filed and tax paid within nine months after the end of the financial year. For companies following the calendar year (Jan 1–Dec 31, 2024), the first deadline is September 30, 2025. Filing is mandatory even if the company’s profit falls within the 0% threshold. For assistance with all federal requirements, we recommend speaking to an expert in corporate tax and compliance.

- Ultimate Beneficial Ownership (UBO): Companies must maintain an accurate register identifying UBOs (defined as those holding 25% or more equity) and submit this information to the DED.

- Economic Substance Regulations (ESR): Applies to mainland companies engaged in ‘Relevant Activities’ (e.g., holding companies, shipping, finance). These entities must demonstrate adequate economic presence (physical office, staff, local expenditure) and submit annual notifications and reports via the Ministry of Finance platform.

- AML/CTF: Under the new federal laws, all entities must maintain robust Anti-Money Laundering and Counter-Terrorist Financing controls, particularly regarding transaction monitoring and reporting.

Case Study: Delayed CT Registration

A Small to Medium Enterprise (SME Founder) assumed that since their initial profit margins were low, they did not need to prioritize Corporate Tax registration until they hit the AED 375,000 threshold. This was incorrect; registration is mandatory for all businesses. We identified the critical timeline and fast-tracked their registration with the FTA, ensuring compliance and avoiding potential penalties associated with missing the first filing deadline of September 2025.

Renewal Costs (DED License Renewal)

The annual renewal process confirms that setting up a business in Dubai is a recurring annual investment, not a one-time fee. For guidance on the recurring costs and processes, see our notes on license costs and renewal. The DED license renewal cost is generally comparable to, or slightly lower than, the initial setup cost, depending on municipal fee changes and administrative costs.

Typical renewal expenses range from AED 10,000 to AED 25,000 annually, influenced by the type of license, the number of activities, and, most importantly, the value of the leased property.

Key Renewal Components:

- DED/DET License Re-issuance Fee: The core cost varies by activity.

- Municipality/Housing Fee (5% of Rent): This is a mandatory, variable charge levied based on the annual value stipulated in the Ejari contract. This fee is often the largest component of the DED license renewal cost and can fluctuate significantly if the rent or assessed rental value changes.

- Local Service Agent Fee: The annual retainer for professional licenses.

- Renewal of the Establishment Card and renewal processing for any employee visas currently tied to the company.

Mainland Setup Checklist (Summary Table)

This checklist provides an easy-level summary of the sequential Dubai economic department steps required for a successful launch.

Dubai Mainland Setup Checklist (The DBTA Rapid Setup Guide)

| Step | Action Item | DBTA Notes | Status |

|---|---|---|---|

| 1 | Define Activity & Legal Form | Ensure 100% ownership eligibility is confirmed. | ☐ |

| 2 | Reserve Trade Name | Submit 3 options; ensure compliance with naming rules. | ☐ |

| 3 | Initial Approval (DED) | Obtain confirmation to proceed with legal steps (2–3 days). | ☐ |

| 4 | Draft & Notarise MOA/LSA | Sign MOA/LSA agreement. Must be done by shareholders or POA. | ☐ |

| 5 | Secure Office & Ejari | Office size dictates visa quota (9m²/visa). | ☐ |

| 6 | Final Submission & License Fee Payment | Pay the DED license cost 2025 vouchers within 30 days. | ☐ |

| 7 | Establishment Card | Register company with immigration and labour for visas. | ☐ |

| 8 | Corporate Banking | Apply immediately post-license; prepare UBO and substance documentation. | ☐ |

| 9 | Compliance Registration | Register for Corporate Tax with FTA (if applicable). | ☐ |

How DBTA Simplifies Your Mainland Setup

The transition to the mainland is layered with complexities that extend far beyond initial paperwork, especially when dealing with international holding structures, judicial deadlines, and stringent banking compliance. Our role is to act as your local corporate shield, converting uncertainty into predictability.

We specialize in three critical areas that often derail unaided setups:

- Strategic Activity Selection and Ownership: We navigate the DED’s ‘Positive List’ to ensure you secure 100% foreign ownership and verify the exact activity code required to prevent bank rejection or mandated external approvals later in the process.

- Guaranteed Cost Certainty: We provide a guaranteed, fixed-fee structure for the entire setup, ensuring you know the final Mainland business setup cost upfront, including all government, legal, and administrative fees, eliminating unforeseen variables.

- Expedited Post-License Compliance: We fast-track your Establishment Card issuance, manage the complex notarization and attestation of foreign documents, and leverage our banking relationships to expedite corporate account opening, minimizing the risk of bank rejection due to UBO or AML concerns.

Conclusion

The regulatory landscape in Dubai has matured significantly. 2025 presents an era of unparalleled opportunity for investors, driven by the freedom of 100% foreign ownership on the mainland. The business setup in Dubai mainland is no longer a compromise; it is the strategic choice for global players seeking genuine local dominance and scalability in the UAE market.

However, the path to a fully compliant, bank-ready mainland company is paved with procedural requirements. Success is measured not merely in securing the license quickly but in expertly navigating the crucial downstream requirements: flawless documentation, securing adequate visa quotas linked to physical substance, and, most critically, mastering the rigorous new compliance regime covering Corporate Tax and AML/UBO requirements.

Do not allow the intricate DED license steps and cost variables to introduce uncertainty into your launch plan. Ready to launch your 100%-owned Dubai venture without bureaucratic uncertainty? Our team at Dubai Business and Tax Advisors specializes in converting this complexity into a single, predictable strategy. Contact us today for a bespoke 2025 Mainland Setup Roadmap, ensuring your market entry is strategic, predictable, and stress-free.

FAQ's:

The total process, including licensing, visa, and banking, realistically spans 4–8 weeks.

Initial costs range from AED 25,000 to AED 50,000+, heavily dependent on office rent and license type.

Yes, securing a physical, RERA-certified office (Ejari) is a non-negotiable DED license requirement for nearly all mainland licenses.

The DED Instant License can be issued in one day, but the whole process (including Ejari, visas, and banking) will still require 4+ weeks.

Documents for mainland setup include Initial Approval, Notarized MOA, Ejari certificate, and passport copies of all partners/managers.

Quota is primarily based on the size of the physical office, with a guideline of 9m² per visa.

No, banking, defense, and oil & gas are examples of sectors that are still restricted by the Negative List.

The Cost is slightly higher than commercial due to the fixed, recurring annual LSA fee component.

Registration with the FTA is mandatory immediately upon incorporation, regardless of whether taxable income is earned.

Banks require proof of economic substance, clarity on the UBO chain, and documents where names and addresses match perfectly.

Unrestricted local market access is the key difference.

The DED mandates the Knowledge Fee (AED 10) and Innovation Fee (AED 10) on every government transaction.

Yes, but it incurs fees and requires DED approval for amendments.

No, VAT and Corporate Tax registration are separate procedures managed by the FTA.

Once the Establishment Card is issued, typically post-license issuance; you can begin the visa application process.

They are based on the selected activity codes, the number of partners, and the specific municipal charges associated with the license type.

Latest news & articles

The 7 Most Common Corporate Tax Mistakes UAE Free Zone Businesses Make: Avoiding the 5-Year Disqualification

Read More »

AED 10,000 Mistake: What Happens If You Miss the UAE Corporate Tax Registration Deadline?

Read More »About the Author:

AURANGZAIB CHAWLA

As CEO of DBTA, Aurangzaib Chawla advises globally mobile businesses and individuals on cross-border tax planning and structuring. With expertise spanning the UK, UAE, and wider GCC, Zaib helps clients minimise double taxation, protect assets, and achieve long-term financial efficiency while staying fully compliant.

Planning to launch in Dubai or the UAE?

Let’s talk about how to structure your business for growth the smart, compliant, and tax-efficient way

About the Author:

AURANGZAIB CHAWLA

As CEO of DBTA, Aurangzaib Chawla advises globally mobile businesses

and individuals on cross-border tax planning and structuring. With expertise spanning the UK, UAE, and wider GCC, Zaib helps clients minimise double taxation, protect assets, and achieve long-term financial efficiency while staying fully compliant.

Planning to launch in Dubai or the UAE?

Let’s talk about how to structure your business for growth the smart, compliant, and tax-efficient way.